Insurance Services

International students in China, students from Hongkong, Macao and Taiwan, as well as overseas Chinese students (identities of overseas Chinese could be proved by relative authority) in healthy condition, able to participate in study normally from 8 years old to 69 years old, are eligible to thispolicy.

Insurance Liabilities

Ping An shall undertake the following insurance liabilities during the valid period of insurance

(Insurance period (from the valid date of the policy to the expiry date of the insurance period))

1. Death insurance:

Ping An shall pay the stipulated amount of insurance compensation if the Insured dies of anaccident ordisease. Insurance liabilities thusterminate.

2. Accidental disability insurance:

If the Insured suffers from an accident which results in any disability listed in the Standardsand Codes for Personal Insurance Disability Assessment (JR/T0083-2013) ( issued by former ChinaInsurance Regulatory Commission, BJF [2014] No. 6 ) within 180 days since the occurrence of the accident, Ping An shall assess the injury and disability according to the

assessment principlesstipulated by this Criteria, unless otherwise stipulated, Ping An shall pay the accidental disability insurance money, whose amount shall be calculated based on

the multiplication ofthe proportion stipulated in this Criteria, which is corresponding to the assessment result, by thesum insured, which is corresponding to insurer's responsibilities. If medical treatment is still notover on the 180th day, disability evaluation shall be made on the basis of the Insured’s physicalcondition on that day and the Insurance of Accidental Disability shall be paid in accordance with theevaluationresults.

If with the disability resulted from this accident and the previous disability combined as a moreseriousdisabilityaccordingtotheStandards and Codes for Personal Insurance Disability Assessment, the insurance shall be paid in accordance with the standard for the more serious disability, but the insurance of accidental disability which has been paid previously (disabilities listed in the Standards and Codes for Personal Insurance Disability Assessment (JR/T0083-2013) ( issued byformer China Insurance Regulatory Commission, BJF [2014] No. 6) have taken place beforepurchase of insurance or caused by events under Liability Exemption, shall be deemed as having been compensated already) shall be deducted there from.

The accumulative payment amount of accidental disability insurance, and death due to any accidental injury or disease shall not exceed the corresponding insured sum of the Insured. If the accumulative amount of payment exceeds the insured sum of the Insured, then the insurance liabilitiestothe insured thus terminate.

Note: Standards and Codes for Personal Insurance Disability Assessment (JR/T0083-2013)(issued by former China Insurance Regulatory Commission, BJF [2014] No. 6 is accessible from the website of Insurance Association of China.

3. Accidental Medical Insurance:

If the Insured, who suffers from the accidental incident, receives medical treatment within 180 days since the occurrence of the accident, the Insurer shall be liable for the full amount of thereasonable and necessary expenses actually paid by the Insured for the medical treatment, but theaccumulative amount of payment shall not exceed RMB 20,000. Whether an accident happens to theInsured for once or several times, the Insurer shall pay the accidental medical insurance respectivelyin accordance with the aforesaid provisions, but the accumulative amount of payment shall not exceedthe insured sum of the accidental medical insurance of the Insured. When the accumulative amount ofpayment reaches the insured sum of the accidental medical insurance of the Insured, the said insuranceliabilityforthe said Insuredshallbeterminated.

For example, the accidents such as bruises of bumps, burns, sprained ankle, accidental cut-wound when cutting vegetables, scratches orbites by cats and dogs.

Reimbursement equation: total amount of reasonable expenditure * 100%=reimbursable amount (the total amount of reasonable expenditures shall exclude the self-paid or partly self-paid items and expenses stipulated by the local regulations of the basic medical insurance).

4. Outpatient and Emergency Medical Insurance:

The reasonable and necessary expenses incurred by the Insured for receiving outpatient or emergency medical treatment because of illness, within each insurance period, the daily limit forout patient is RMB 600,( that means, if medical expense exceeding RMB 600 per day, shall be

calculated as RMB 600; if the medical expense not exceeding RMB 600 per day, shall be calculated bythe actual amount). Once the medical expenses exceeding the starting line of RMB650, the remaining amount of the medical expenses exceeding the deductible RMB 650 yuan on the basis of the daily limit rules will be reimbursed at a percentage of 85%, and the accumulative payment shall not exceedthe limit of RMB20000. The insurance liability shall be terminated once the accumulative amount of payment reaches the sum insured.

Medical expenses of outpatient and emergency treatment: The related expenses incurred fromgeneral outpatient treatment, emergency treatment, outpatient surgery, hospitalization for observation, emergency rescue, isolation due to infectious diseases that is certified by the publichospital or department of public health and epidemic prevention, and expense or cost of outpatient and emergency treatment before and after hospitalization that arise from the same cause of disease are also deemed as outpatient and emergency treatment.

For example, being treated in the outpatient or emergency for fever, sudden abdominal

pain, faint, and inflammation etc.

Reimbursement equation: (the expense of each day within the daily limit RMB600 yuan addup-650yuan) *85% = reimbursableamount

(the total amount of reasonable expenditures shall exclude the self-paid or partly self-paid items and expenses stipulated by the local regulations of the basic medical insurance)

Definitions:

Daily limit: The top claim limit of available medical cost.

Deductible: RMB 650 yuan (A total of RMB650 yuan is deducted accumulatively for one time during an insurance period ). Below the starting line, there is no compensation.

5. Hospitalization and Medical Insurance:

If diagnosis confirms that the Insured must be hospitalized for treatment because of suffering from the accident or the illness, Ping An shall pay 100% of the“hospitalization and medical insurance”to the insured with regard to the actual and reasonable expenses for medical treatment, including reasonable and necessary fees fornursing ( limited to RMB 200 Yuan

per day and accumulate up to 60 days), medical record, heating, air-conditioning, bed, examination, specialexaminationand treatment,operation,medicine, treatment, laboratory test,

radiation, etc.

During one valid insurance period, whether the Insured is hospitalized for once or several times,the Insurer shall pay the insurance payment as per compensation rule, but the insurance liability shall be terminated once the accumulative amount of payment reaches the limitation of RMB 400,000.

In another word: if diagnosis confirms that the insured must be hospitalized for treatment becauseof suffering from the injury or illness, the insured may apply online for advanced payment by thehospital orathisown expense of medicalexpenseforhospitalizationandreimburse later.

Reimbursement equation: reasonable hospitalization expenditure * 100%=reimbursable amount (the total amount of reasonable expenditures shall exclude the self-paid or partly self-paid items and expenses stipulated by the local regulations of the basic medical insurance).

Note:

(1) Medical organizations which are involved in all the foregoing medical insurance liabilities are limited to the public hospitals established within the border of MainlandChina; However,for the insured who are treated in the ward area for foreigners, ward area for VIPs, private room, Class A ward, separate ward room, ward area for special treatment and needs, ward fo special treatment and needs, ward for high-ranking officials,or similar ward area

of the public hospitals, shall be excluded from the insurance, then all medical expenses incurred by such shall not be covered by the insurer.

(2) Medical treatment expenses generated by all the foregoing medical insurance liabilitiesare limited to the items and expenses that can be reimbursed in accordance with the local regulations of basic medical insurance, the self-paid or partly self-paid itemsand expensescannotbe reimbursed bythe insurer.

(3) For the insured who apply for the insurance for the first time or the insured who is notrenewal of insurance, the first 30 days from the effective date of the insurance is the waitingperiod (observationperiod ). Where the insuredis hospitalizedor treated in outpatient during the waiting period and related medical cost occurs, the insurer bears no liability of compensation. Insurance renewal or the treatment for the Insured suffered from an accident isnotsubject to any waiting period.

(4) If any third party has partiallyor fully paid anyabove-mentioned medical treatment fees, Ping An shall be liable for the remaining amount of reasonable fees that are within there imbursable payments copeofthelocalbasicmedicalinsurance. But the limited portion of the fees for the bed, nursing, outpatient and emergency treatment within the daily limitation isalsolimited; if the third party has aspecified proportion for payment of the limitedsum, Ping An shall be liableonly for the remaining amount after deducting the already paid amount from the limited sum. If the third party has no specified proportion for payment, then Ping An shall be liable for the remaining amount, but not exceeding the insured sum, after deducting the standard amount of this item from the limited sum which takes the regulations of the local basic medical insurance as the standard.

(5) If the Insured suffers from a major disease or achronic disease before the purchase of this insurance, the Insurer shall not bear the liability of payment.

Liability Exemption

I. Liability Exemption for Death and Accidental Disability Insurance

Ping An shall be exempted from the insurance liabilities for death and accidental disability caused by any of the following circumstances on the part of the Insured:

(1) Deliberate killing or injury conducted by the policy-holder or beneficiary to the

Insured;

(2) Deliberate self-harm, suicide, intentional crime, resistance to criminal compulsory

measures taken accordingto the law on the part of the Insured;

(3) Fighting, drunkenness or affected by alcohol, and active taking, sucking or injection ofdrugsonthe partof the Insured;

(4) Driving a motor vehicle under the influence, driving a motor vehicle without a legal and valid driving license or driving a motor vehicle without a valid driving license on thepartof the Insured;

(5) War,military conflict, riot or armed rebellion;

(6) Nuclear explosion,nuclear radiation or nuclear pollution;

(7) Pregnancy, abortion, miscarriage, delivery(includingcaesareanbirth), birthcontrol, treatment of infertility, contraceptive sterilization, artificial impregnation and related complication on the part of the Insured;

(8) Medical accident occurring to the Insured because of cosmetic surgery or other surgical operations;

(9) Taking of medicine (excluding OTC medicine taken according to instructions) without permission of doctoron the part of the Insured;

(10) During the period when the Insured suffers from AIDS or is infected with the AIDSvirus(HIV-positive);

(11) The Insured engages in high-risk activities such as diving, parachuting, mountain

climbing,bungee jumping, paragliding, expedition, wrestling, martialart, stunt

performance, horse racing, carracing, etc.

(12) The Insured passes away or becomes disability because of an accident outside mainland China.

(13)Providing false insurance information, or non-overseas students insured as an overseas student.

(14)Those accidents that occur during the time when the Insured do their part-time job;

If the Insured is caused dead in any of the foregoing circumstances, Ping An shall terminate the insurance liability of the Insured.

II. Liability Exemption for Medical Insurance Liability

(Accidental Medical Treatment, Outpatient, Emergency and Hospitalization)

Ping An shall be exempted from the insurance liabilities for medical expenses caused by any of the following circumstances on the part of the Insured:

(1) Deliberate killing or injury conducted by the policy-holder or beneficiary to the

Insured;

(2) Deliberate self-harm, intentional crime or resistance to criminal compulsory measures taken according to the law on the part of the Insured;

(3) Fighting, drunkenness or affected by alcohol, and active taking, sucking or injection of drugs on the part of the Insured;

(4) Driving a motor vehicle under the influence, driving a motor vehicle without a legal andvalid driving license or driving a motor vehicle without a valid driving license on the part of the Insured;

(5) War,military conflict,riot or armed rebellion;

(6) Nuclear explosion, nuclear radiation or nuclear pollution;

(7)The insured suffers from congenital diseases, hereditary diseases,existingdisease (disease or symptoms that already exist prior to the date of insurance and non-continuous within the insurance period);

(8) The insured suffers from AIDS or HIV infection, sexually transmitted diseases;

(9) Pregnancy, miscarriage or delivery on the part of the Insured, infertility treatment, artificial insemination, prenatal and postnatal check, birthcontrol (including sterilization), abortion and complications caused by above-mentioned causes;

(10) Medical accident occurring to the Insured because of cosmetic surgery or other surgicaloperations;

(11) The medical expenses incurred by the Insured for dental care, such as washing teeth,dentures, dental implants, false filling, porcelain teeth, etc., as well as expenses incurred in oral restoration, orthodontics, oral health care and beauty; the reasonable medicalexpenses of the Insurer's dental fillings, tooth nerve treatment, tooth pulling, tooth impaction treatment and periodontal diseases (such as,

periodontitis, gingivitis, periapical inflammation, except for teeth cleaning) due to dental caries, dental pulp disease and cracked teeth are within the insurance liability of the Insurer;

(12) Expenses of orthopedics, correct procedure, plastic surgery or rehabilitation therapy received by the Insurer;

(13) Items such as physical examination and disease screening for the Insured; various medical treatment items for prevention, health care, recuperation, rest and special care: such as various vaccines vaccination, foot reflexology massage therapy, fitness massage and other items;

(14) Taking, application or injection of medicine without the permission ofdoctor on the part of the Insured;

(15) Medical expenses incurred outside Mainland China or in private hospitals within

Mainland China, and expenses incurred in drugstores and companies of medical apparatus and instruments;

(16) Accidents that occur outside Mainland China and the follow-up treatments as a consequent on the part of the Insured;

(17) Charge of telephone, transportation, meals,etc. on the part of the Insured;

(18) Sports and athletic activities of high risk only professionals participate. (The Insuredengages in high-risk activities such as diving, parachuting, paragliding, roller skating,skiing, skating, bungee jumping, rock climbing, wrestling, judo, taekwondo, martial art,karate,fencing,etc.

(19) Providing false insurance information, or non-overseas students insured as an overseas student.

(20) Experimental treatment and costs incurred for medical experiment purpose.

(21)The insurant should turn to medical treatment in strict accordance with the hospital admissions standards. If not, the insurer does not reimburse the cost of hospitalization.

(22)Medical treatment fees incurred without reporting in advance by dialing 400 telephone numbers or not approved.

(23) Relevant expenses incurred by the Insured during the time when they do their part-timework.

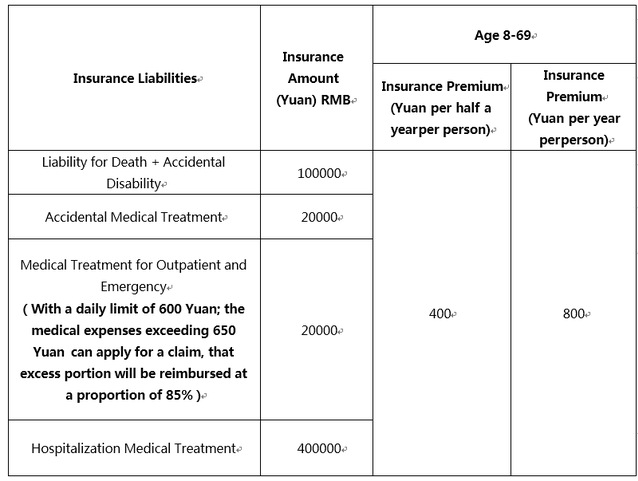

Insurance premium

Note:

Matters not mentioned herein shall be executed according to Ping An One-year Group Term LifeInsurance (RELEASED BY PING AN ANNUITY INSURANCE COMPANY OF CHINA, LTD[2009]

No.105 ), Ping An Additional Accidental Injury Group Medical Insurance (RELEASED BY PING ANANNUITY INSURANCE COMPANY OF CHINA, LTD [2020] No.413), Ping An Inpatient Group Medical Insurance (RELEASED BY PING AN ANNUITY INSURANCE COMPANY OF CHINA, LTD [2020] No.413 ), Ping An Inpatient, Outpatient and Emergency Comprehensive Group MedicalInsurance (RELEASED BY PING AN ANNUITY INSURANCE COMPANY OF CHINA, LTD [2020] No.413), and Ping An Inpatient Reassuring Group Medical Insurance (Clause A) ( RELEASED BY PING AN ANNUITY INSURANCE COMPANY OF CHINA, LTD [2020] No.413).

If any dispute arises concerning the contents mentioned above,the Chinese interpretation shall prevail.

Please be sure to call 4008105119 firstly to make a diagnosis inquiry before you go to see a doctor.